In 2026, the most eye-catching asset was not Bitcoin.

It was not stocks.

It was gold.

After surging nearly 20 percent in just two weeks, gold suddenly collapsed. On last Friday’s market session, prices recorded the largest single-day drop in nearly 50 years, falling 11.4 percent. When markets reopened on Monday, selling pressure continued in waterfall fashion, pushing gold down toward the 4500 dollar support level.

That level failed to hold.

This raises a question many investors are now asking.

Is gold finally crashing?

What This Article Will Explain

In this analysis, we answer four key questions:

What Really Drives Gold Prices

Gold is both an asset and a commodity.

This dual identity means its price is influenced by multiple forces.

Gold as a Commodity

Gold is widely used in industrial components and consumer goods. India is one of the world’s largest gold consumers. According to the World Gold Council, gold is considered auspicious in Indian culture. Demand typically rises during major festivals such as Diwali and harvest celebrations.

However, these consumption-driven factors play a relatively minor role compared to gold’s financial function.

Gold as a Safe Haven Asset

In the short term, gold is positively correlated with geopolitical instability.

Gold is the ultimate hedge against sovereign currency failure. During periods of geopolitical stress such as the Russia–Ukraine conflict or tensions involving Iran, capital flows into gold seeking safety.

That said, event-driven rallies tend to be fast and temporary. Volatility caused by headlines usually fades quickly.

Gold Versus the US Dollar

As a global monetary asset, gold stands opposite the world’s dominant currency, the US dollar.

When the dollar weakens, gold strengthens.

The Most Overlooked Factor

Real US Treasury Yields

One factor is often ignored by retail investors:

inflation-adjusted real yields on US Treasuries.

Many explanations for the recent gold collapse focus on surface-level narratives such as easing geopolitical tensions or a stronger dollar. These miss the core driver.

Why Real Yields Matter More Than Headlines

Gold is a non-interest-bearing asset.

US Treasuries are considered low risk and generate yield.

When real Treasury yields rise, the opportunity cost of holding gold increases. Investors naturally prefer assets that offer real returns.

Many traders only watch the Federal Reserve’s nominal interest rates and assume higher rates are bearish for gold. But this logic is incomplete.

If inflation is also high, real yields may remain low or even negative. In that environment, Treasuries are unattractive and gold benefits.

This time, that equation changed.

And when real yields rose, the foundation of gold’s bull market weakened.

What Triggered the Gold Collapse

The catalyst can be traced to one name.

Kevin Warsh.

Last week, Donald Trump nominated Kevin Warsh as the next Chairman of the Federal Reserve.

Compared to the current Chair Jerome Powell, Warsh is seen as more politically agile. He aligns with Trump’s push for faster rate cuts while maintaining credibility on inflation control.

So how does he plan to do both?

Balance sheet reduction combined with rate cuts.

Why Trump Wants Rate Cuts So Badly

Trump’s frustration with Powell stems from slow rate cuts.

The reason is simple.

The US government is buried in debt.

As discussed in our previous article:

In December 2025, the US fiscal deficit reached 145 billion dollars, up 67 percent year on year. The cumulative deficit climbed to 602 billion dollars, representing 6.4 percent of GDP. This level has persisted for two consecutive years, a scale last seen during World War Two.

If interest costs remain high, debt servicing becomes unsustainable. Lower rates are essential to prevent fiscal stress.

Warsh appears more willing to accommodate this pressure.

Why Gold Fell Despite Rate Cut Expectations

At first glance, rate cuts should boost gold.

But cutting rates alone risks reigniting inflation and undermining the dollar.

To counter this, Warsh’s strategy includes quantitative tightening. By selling US Treasuries and draining liquidity, inflation pressures are suppressed, creating room for rate cuts.

This creates a powerful sequence:

- Treasuries are sold

- Nominal yields rise to attract buyers

- Liquidity tightening suppresses inflation

- Real yields increase

As real yields rise, the opportunity cost of holding gold rises.

Gold sells off.

Is the Gold Bull Market Over

If Warsh becomes Fed Chair and executes this strategy, rising real yields would likely continue to pressure gold. At minimum, the gold bull market appears paused.

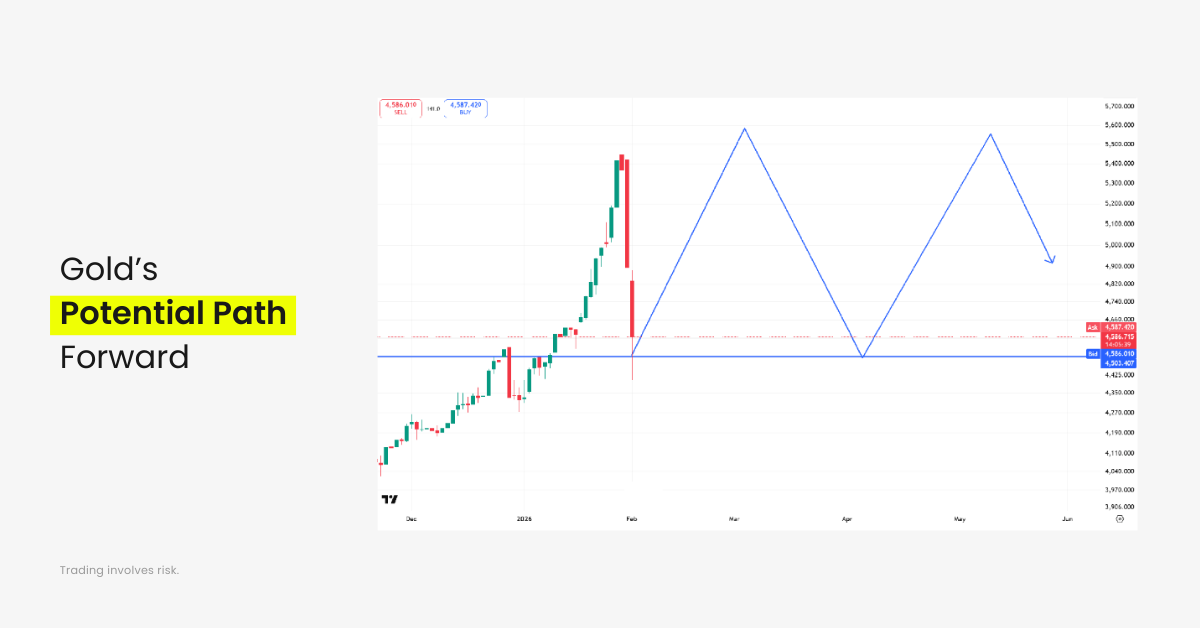

From D Prime’s spot gold daily chart, this decline is sharp and aggressive. This is not a simple technical pullback. It resembles distribution at a market top, with large capital rotating into higher-yielding Treasuries.

The 4500 dollar zone forms an initial support area. After panic subsides, bargain hunting could drive a rebound toward previous highs. However, heavy overhead supply means upside potential is limited.

D Prime believes gold is unlikely to make new highs in the near term and may enter a range-bound consolidation.

If 4500 fails decisively, the next key support lies near 3400 dollars.

What Happens After Consolidation

After consolidation, will gold rise or fall?

At this stage, no one can say with certainty.

Warsh may not take office.

Geopolitical risks could escalate unexpectedly.

Markets cannot be predicted. They can only be followed.

Patient investors should avoid rushing trades within a volatile range. Waiting for a clear breakout or breakdown offers better risk management.

If Gold Loses Momentum What Is Next

Assuming Warsh takes office and faces pressure to cut rates while controlling inflation, one asset stands out.

Crude oil.

Oil as the Anchor of the Dollar System

Oil is effectively anchored to the US dollar.

If inflation returns, oil prices rise. Higher energy costs suppress consumption and economic overheating.

Because oil is priced in dollars, oil-exporting nations accumulate large dollar reserves. These dollars often flow back into US Treasuries, helping fund US debt at relatively low interest rates.

This cycle supports:

- Dollar strength

- Treasury demand

- US asset prices

In a strong dollar environment, gold typically struggles.

Final Thoughts

Under a tightening plus rate cut policy mix, D Prime believes the risk of runaway inflation remains relatively low. But markets are never linear, and policy outcomes are never guaranteed.

No investor can read the minds of central bankers.

No model can predict every shock.

What does work is staying alert, reading the signals, and adapting when the narrative shifts.

Markets move fast. Cycles turn quietly.

Those who stay flexible move first.

Follow D Prime for clear, timely, and actionable macro insights — so you are not reacting late, but positioning early.

Risk Disclosure

Trading in Securities, Futures, contracts for difference (CFDs) and other financial products carries high risks due to the rapid and unpredictable fluctuation in the value and prices of these financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.

Disclaimer

This article may contain speculative statements regarding future expectations, plans, or projections based on information and assumptions currently available to D Prime. Although D Prime considers these assumptions reasonable, such statements involve risks, uncertainties, and factors beyond D Prime’s control, and actual outcomes may differ significantly.

This information contained in this blog is for general informational and educational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance and D Prime and its affiliates give no assurance that any views, projections, or forecasts will materialize.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness or reliability of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial trading or investment decisions.

“D Prime” is a brand name of D Prime Vanuatu Limited, a company incorporated and regulated by the Vanuatu Financial Services Commission (Company Number: 700238). The availability of products and services may vary depending on jurisdiction and applicable regulatory requirements.