Let us welcome you to the era of leverage – one powerful tool that is engaging more and more investors in the world of trading. When listening to this group of traders, you may often hear positive opinions about leverage, especially regarding how it can directly improve capital efficiency and expand trading possibilities. But is this really true, and does it work the same way for everyone?

In this article, we will explore the fundamentals of leverage, including leverage meaning, how it works, and what is leverage in trading in practical terms. Based on this understanding, you will be able to assess whether the leverage offered at D Prime suits your trading goals and how you can benefit from it responsibly. Now, let’s get right into it!

Leverage & All You Need To Know

What Is Leverage?

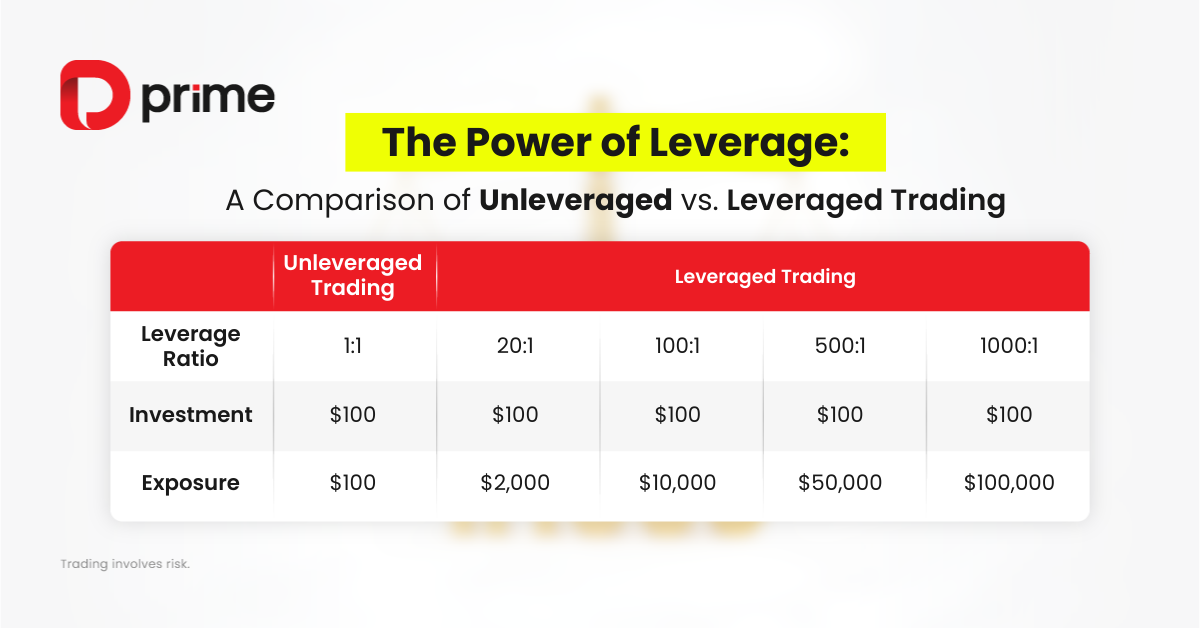

To put it simply, leverage meaning refers to a trading tool that allows traders to open positions larger than their initial deposit. For example, the ratio between your original deposit (known as your Margin) and your total market exposure can be 1:20, 1:100, 1:500, or even 1:1000, depending on the broker and the asset you trade.

By utilizing leverage, traders can maximize market exposure even with modest capital, making it possible to participate in markets such as Forex, commodities, or even instruments like a gold leveraged ETF.

How Does Leverage Work?

Leverage works when you place a deposit, known as the initial margin, which allows the broker to provide increased exposure to the selected asset. This explains what is leverage in trading from a practical perspective: your margin acts as collateral, while the remaining exposure is provided by the broker.

In short, while leverage multiplies your buying power, margin is the actual amount of capital locked to control a much larger position. The margin cost depends on the leverage ratio used and the asset being traded.

This is why choosing the right leverage level from a reliable broker is crucial. With the right setup, traders can access larger positions while keeping the margin requirement manageable.

What Leveraged Products Can You Trade?

Due to the widespread application of leverage across financial markets, it has gained strong popularity among traders. Leveraged trading is commonly available in:

- Forex

- Futures

- Precious Metals

- Spot Index CFDs

- Commodities

At D Prime, we proudly offer leverage across all the markets mentioned above, giving traders flexibility whether they are trading currencies, commodities, or diversified products such as a gold leveraged ETF.

2. Leverage Trading Benefits: A Close‑Up Between Unleveraged vs. Leveraged Trading

With leverage, traders can go further than expected by accessing higher trading opportunities with less capital pressure. This allows traders to expand their investment portfolio and increase capital efficiency.

Let us walk through an example to better illustrate the core differences between trading with and without leverage.

As shown in the table above, in unleveraged trading, $1 allows you to trade only $1 worth of financial instruments. However, in leveraged trading, $1 can control significantly more than $1 in exposure.

For example, imagine having $100 in initial capital and wanting to open a position worth $100,000. Without leverage, this would be nearly impossible. However, with a 1:1000 leverage ratio, this scenario becomes achievable, as the required margin is significantly reduced. This demonstrates the practical leverage meaning and how it can unlock new trading possibilities.

Leverage at D Prime – One of the Best in the Market

At D Prime, we offer leverage ratios of up to 1:1000 across our product ecosystem. This allows traders to choose the leverage level that best fits their strategy while managing their margin efficiently.

By offering high leverage, D Prime enables traders to open full positions with a relatively low margin cost, amplifying potential profits compared to unleveraged trading. Traders remain in control by selecting suitable leverage levels based on their experience and risk tolerance.

For detailed leverage specifications for different products, kindly refer to the leverage table below.

Tips to Take Advantage of Our 1:1000 Leverage

Before using high leverage, it is important to understand that leverage itself is just a tool. The amount of leverage does not automatically increase risk; instead, the final outcome depends on the trader’s knowledge, discipline, and strategy. However, higher leverage does magnify gains and losses, making risk management utmost essential.

To help traders manage leveraged positions, D Prime offers several risk‑management tools, including:

Stop Loss Order

You may have heard the term often, but what is a stop loss order exactly?

A stop loss order is a predefined instruction that automatically closes a trade when the market reaches a certain price level. Understanding what is a stop loss order helps traders limit downside risk when markets move unexpectedly.

With both guaranteed stop loss and basic stop loss order options, traders can protect their positions even during market gaps or slippage. More importantly, a stop loss order is especially valuable for traders who cannot monitor the markets continuously, as it helps manage risk automatically when prices move unexpectedly.

Take Profit Order

“Take profit” is exactly what every “take profit trader” aims for.

When a “take profit trader” sets a take‑profit level, the position is automatically closed once the target price is reached. This ensures that profits are secured regardless of sudden market reversals.

Negative Balance Protection

To put it simply, negative balance protection is an automatic safeguard rather than a trading order. It ensures traders never lose more than their deposited funds.

But what is negative trade balance protection in practice?

It means that if your account equity goes negative due to sudden market changes, D Prime will help cover the negative portion of the loss, ensuring that your maximum loss is limited to your total initial investment.

By understanding what is negative trade balance protection, traders can feel more at ease when entering leveraged trades.

Final Thoughts

All in all, leverage is a powerful trading tool, and D Prime even enhances much more flexibility by offering up to 1:1000 leverage. However, while trading opportunities widen, risks also increase. This is why traders should combine leverage with sound strategies, proper margin management, and protective tools such as stop loss order placement and take‑profit planning.

With this trading tool in hand, our team hopes that our comprehensive trading ecosystem empowers every trader, including you, to trade with greater confidence.

We wish you a pleasant trading experience with D Prime, supported by our advanced tools, flexible margin system, and industry‑leading leverage solutions!

Risk Disclosure

Trading in Securities, Futures, contracts for difference (CFDs) and other financial products carries high risks due to the rapid and unpredictable fluctuation in the value and prices of these financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks.

Disclaimer

The information contained herein is provided for general informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, a recommendation, or an offer or solicitation to buy or sell any financial instruments or engage in any trading strategy.

Trading in leveraged products such as contracts for difference (CFDs) involves a significant risk of loss and may not be suitable for all investors. Past performance is not indicative of future results. Any references to market trends, asset performance, price levels, or forward-looking statements reflect opinions or general market commentary as at the date of publication and are subject to change without notice.

This article does not take into account any individual investor’s objectives, financial situation, or risk tolerance. Readers should conduct their own independent research and seek professional advice before making any investment or trading decisions. D Prime and its affiliates make no representations or warranties about the accuracy or completeness or reliability of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained herein. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Do not rely on this report to replace your independent judgment.

“D Prime” is a brand name of D Prime Vanuatu Limited, a company incorporated and regulated by the Vanuatu Financial Services Commission (Company Number: 700238). The availability of products and services may vary depending on jurisdiction and applicable regulatory requirements.